themagnate 2018-02-28 18:02:44

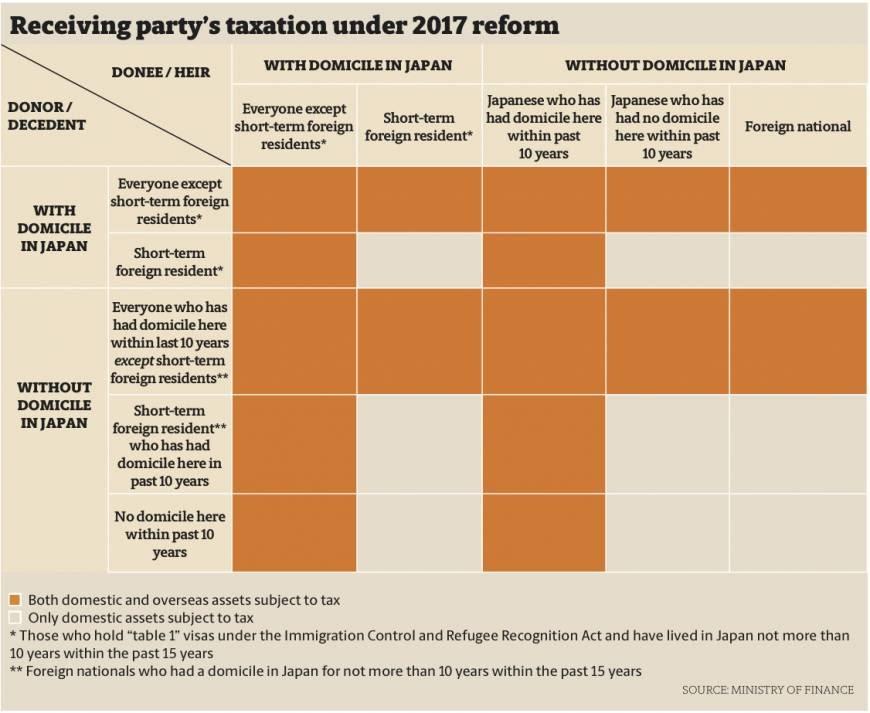

Foreign residents need to be careful of the 2017 tax reforms that may subject their families' assets to Japanese inheritance taxes. Anybody with permanent residency or a spousal visa may find that Japan has a claim on their parents' assets, even if their parents have never lived or worked in Japan.

This appears to primarily apply to holders of Table 2 visas (Permanent Residency, Spousal Visa, Long Term Resident) while most holders of Table 1 visas are exempted. It can be applied up to 10 years after you've left the country.

Imagine forfeiting half of your mother's life savings to the Japan tax office, even though she was not and had never been a resident of Japan, nine years after leaving Japan. Tax rates go as high as 55% apparently.

Disclaimer: I am not a CPA or an attorney. I encourage comments that clarify the implications of this tax law for people working in and investing in the Niseko region.